Imagine you’re a mid-level manager at a manufacturing plant, and suddenly, you hear the news: Precipart Acquireedt has been acquired by a larger entity. Initially, you feel a mix of concern and curiosity. What does this mean for your job, your company, and the industry at large? As we glance ahead to 2025, let’s unravel the layers behind this acquisition and what it might imply for all stakeholders involved.

What Does the Acquisition Mean?

Overview of Precipart Acquireed and Its Industry Role

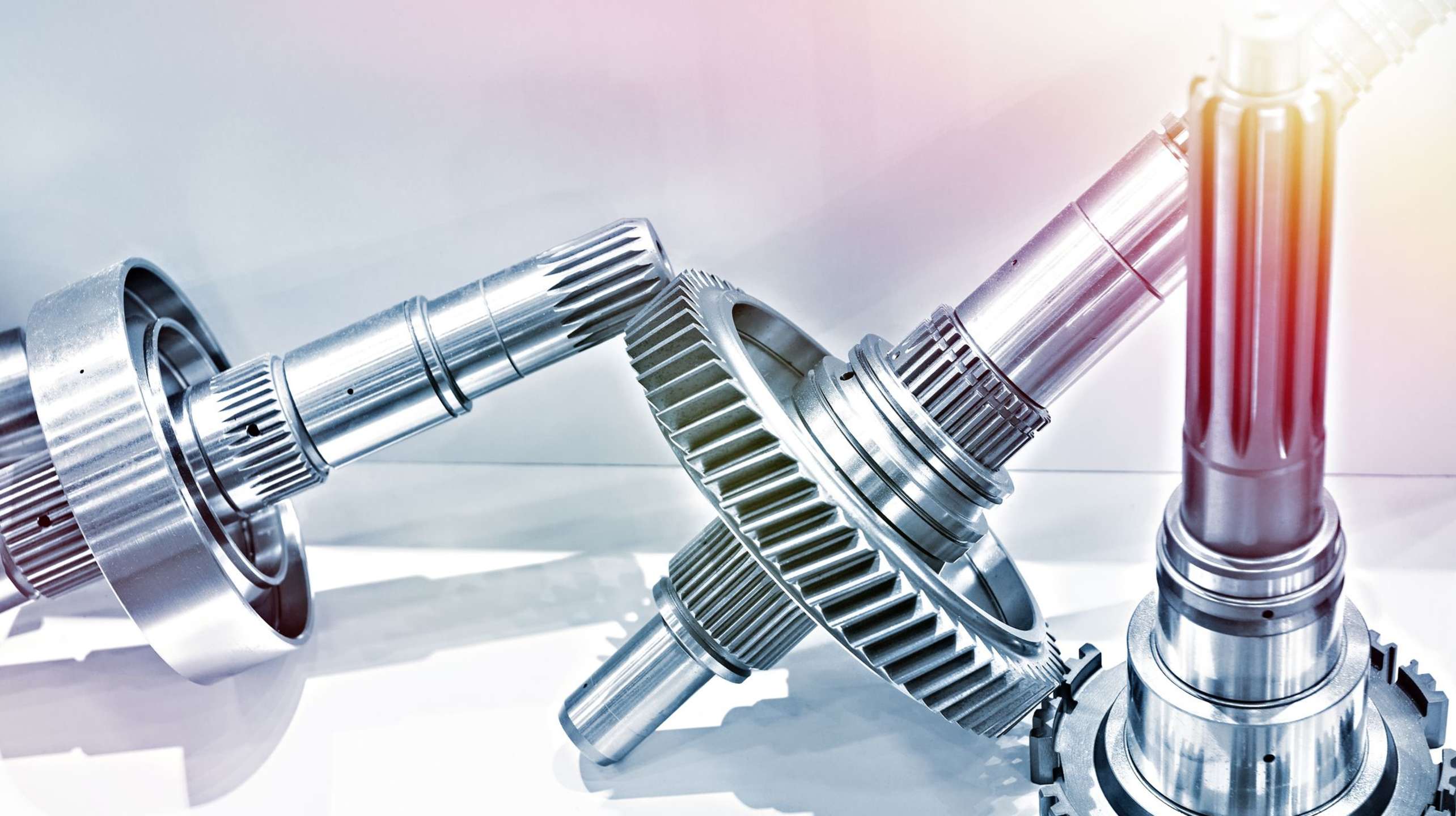

Precipart Acquireed has carved out a significant niche in the manufacturing sector. Known for its innovative engineering solutions, the company has consistently delivered unique products that meet the evolving needs of its clients. But what exactly does this mean for you as a consumer or a business partner?

Precipart specializes in precision components and assemblies. Their expertise spans various industries, including aerospace, medical, and robotics. This diverse portfolio allows them to adapt to market changes and customer demands swiftly. Their reputation for quality and reliability has made them a go-to provider for many companies.

The Strategic Reasoning Behind the Acquisition

So, why did this acquisition happen? The motivation often lies in the potential for growth and innovation. Companies often seek acquisitions to enhance their capabilities, expand their market reach, or integrate new technologies.

- Expansion of Capabilities: By acquiring Precipart, the parent company likely aims to bolster its existing product line with Precipart’s advanced engineering solutions.

- Market Positioning: This move can enhance the competitive edge, allowing the parent company to offer a broader range of products and services.

- Innovation Boost: As noted by an industry expert,

“Acquisitions like these often signal a new direction for innovation across the board.”

This suggests that the acquisition could lead to groundbreaking advancements.

Possible Shifts in Market Competition

With this acquisition, the landscape of competition may shift significantly. You might wonder how this affects the market dynamics. Here are a few possibilities:

- Increased Competition: Other players in the market may need to ramp up their innovation to keep up with the newly strengthened entity.

- Price Adjustments: The acquisition could lead to changes in pricing strategies, either lowering prices to gain market share or increasing them due to enhanced capabilities.

- New Partnerships: The acquisition may open doors for new collaborations, which can lead to more innovative solutions.

Immediate Effects on Partnerships

Partnerships are crucial in any industry, and acquisitions can have immediate impacts on them. For current partners of Precipart, this acquisition may lead to:

- Reevaluation of Contracts: Existing agreements might need to be revisited to align with the new strategic direction.

- Integration of Services: Partners may benefit from enhanced services or products as Precipart integrates its offerings into the parent company’s portfolio.

- Uncertainty: There could be a period of uncertainty as partners assess how the acquisition affects their collaborations.

Background of Precipart and Market Pressures

To understand the acquisition’s implications, it’s essential to analyze the background of Precipart. The company has faced increasing pressure to innovate due to rapid technological advancements and changing customer expectations.

Market pressures often lead to strategic decisions, such as mergers and acquisitions. Companies feel the need to stay relevant. They must adapt to survive. This acquisition is a clear response to those pressures.

Precipart’s Revenue Growth Rate

Before the acquisition, Precipart had a commendable revenue growth rate. This growth indicates a healthy demand for its products and services. This performance likely made the company an attractive target for acquisition.

Post-Acquisition Industry Share

After the acquisition, the percentage of industry share held by the combined entity will be crucial. This new market position can dictate pricing, influence customer choices, and shape future innovations. As a consumer or a business partner, understanding these dynamics can help you navigate the changing landscape.

In summary, the acquisition of Precipart has far-reaching implications. From shifts in market competition to immediate effects on partnerships, it’s a pivotal moment in the industry. The changes ahead will be interesting to watch, and they may redefine how we perceive engineering solutions in the manufacturing sector.

Expectations for 2025 and Beyond

As we look ahead to 2025, the business landscape is shifting rapidly. What can you expect? Here are some key predictions and trends that are likely to shape the future.

1. Predictions on Operational Changes

Operational changes are on the horizon. Companies are adapting to new technologies and market demands. This could mean streamlining processes or even overhauling entire business models. Think about it: how often do you see a company adjust its operations to stay relevant?

- Increased automation: Many businesses will likely adopt more automated systems.

- Remote work normalization: The pandemic has shown that remote work can be effective.

- Data-driven decision-making: Companies will rely more on data analytics to guide their strategies.

These changes can lead to greater efficiency but may also require employees to adapt quickly. Are you ready for that shift?

2. The Potential for Job Creation or Loss

With operational changes come questions about jobs. Will there be more jobs created, or will automation lead to job loss? It’s a critical question. Many experts suggest that while some roles may disappear, new ones will emerge.

- Job Creation: New technologies often lead to new job categories. Think about roles in AI, data science, and cybersecurity.

- Job Loss: Automation may replace some tasks, particularly in routine jobs.

As businesses evolve, they may focus on upskilling their workforce. This could mean offering training programs to help employees transition into new roles. It’s a balancing act, but one that many companies are willing to take on.

3. Long-term Industry Collaborations

Long-term collaborations between industries are becoming more common. Companies are realizing that working together can lead to better outcomes. This trend is likely to continue into 2025 and beyond.

- Shared Resources: Companies may share technology and research to innovate faster.

- Cross-Industry Partnerships: Collaborations between different sectors can lead to groundbreaking solutions.

Imagine the possibilities when two industries combine their strengths. It’s like mixing ingredients to create a new recipe. What delicious innovations could come from this?

4. Innovative Projects Resulting from Combined Resources

Innovation is often born from collaboration. When companies pool their resources, they can tackle challenges that one organization alone might struggle with. This can lead to exciting projects.

- Joint Ventures: Companies may create joint ventures to explore new markets.

- Research Initiatives: Collaborating on research can speed up innovation.

These innovative projects can lead to products and services that revolutionize industries. Just think about how many things we use today that didn’t exist a decade ago!

5. Industry Growth Rates Post-Acquisition

Data shows that industries often experience growth after significant acquisitions. For example, many companies see an increase in market share and profitability.

In 2025, we can expect to see similar growth rates. Companies that make strategic acquisitions may find themselves leading their sectors. This growth can be a boon for the economy and create new opportunities for workers.

6. Employee Satisfaction Scores in Similar Cases

What about employee satisfaction? In many instances, companies that adapt and evolve see higher satisfaction scores among their employees. A happy employee is often a productive one.

As businesses transform, they may prioritize employee engagement. This can lead to improved morale and retention rates. After all, who doesn’t want to work for a company that values their input?

“For many businesses, this marks a pivotal moment for reassessment and innovation.” – Analyst Commentator

The landscape is changing. Many predict that these changes will spur job creation as business units evolve and adapt their strategies to the new market landscape. Are you prepared for what’s coming?

In summary, the future holds a lot of promise. With operational changes, potential job shifts, and innovative collaborations, the business world is set for an exciting transformation. Keep an eye on these trends as we move closer to 2025.

Navigating Potential Challenges

In the wake of a merger or acquisition, businesses often face a myriad of challenges. These challenges can be daunting, but they also present opportunities for growth and innovation. Let’s explore some of the key areas where you may encounter obstacles and how to navigate them effectively.

1. Understanding the Shift in Corporate Culture

When companies merge, they bring together distinct corporate cultures. This shift can lead to confusion and conflict. You might wonder, how can two different ways of working coexist. It’s essential to recognize that culture is not just about policies; it’s about the people and their values.

- Assess the Current Cultures: Take time to understand the existing cultures of both organizations. What are their strengths and weaknesses?

- Encourage Open Dialogue: Create forums where employees can express their concerns and ideas. This promotes inclusivity.

- Develop a Unified Vision: Work together to create a shared mission that reflects both cultures. This helps in aligning goals.

As a business strategist once said,

“Every acquisition comes with its pains, but also opportunities for resilience and creativity.”

This means that while challenges exist, they can also lead to innovative solutions.

2. Dealing with Possible Redundancies

Redundancies are often a harsh reality in mergers. You may find yourself in a position where roles overlap, leading to tough decisions. It’s crucial to handle this delicately.

- Communicate Transparently: Inform your team about potential changes as soon as possible. Transparency builds trust.

- Offer Support: Provide resources for those affected. This could be in the form of counseling or job placement services.

- Focus on Retention: Identify key talent and work to retain them. Their skills may be vital for future success.

Historical statistics show that employee turnover often spikes during mergers. Companies that prioritize communication and support tend to have better retention rates.

3. Establishing New Communication Channels

Effective communication is vital during any transition. Mergers can disrupt established lines of communication, leaving employees feeling disconnected. How can you ensure that everyone stays informed?

- Leverage Technology: Use collaboration tools and platforms to keep everyone connected.

- Regular Updates: Schedule frequent meetings to share updates and address concerns.

- Encourage Feedback: Create channels for employees to voice their thoughts. This can help identify issues early on.

By fostering open communication, you can build a stronger, more cohesive team. Remember, communication is not just about sending messages; it’s about listening too.

4. Adapting to Changes in Supply Chain Dynamics

Mergers often lead to shifts in supply chain management. You may need to adapt to new suppliers or logistics partners. This can be overwhelming, but it’s essential for maintaining operations.

- Evaluate Current Suppliers: Assess the strengths and weaknesses of all suppliers involved. Determine who can best meet your needs.

- Streamline Processes: Look for ways to simplify your supply chain. This could lead to cost savings and increased efficiency.

- Build Relationships: Establish strong relationships with new partners. Trust is key in any business relationship.

Adapting to these changes can be challenging, but it also opens doors to new opportunities. Companies that remain flexible often find innovative solutions to supply chain issues.

Navigating these challenges requires a shift in mindset and strategy. You must be proactive and willing to adapt. The business ecosystem is ever-changing, and those who embrace change will thrive.

In conclusion, while the road ahead may be filled with obstacles, remember that each challenge is also an opportunity for growth. By understanding cultural shifts, managing redundancies, establishing clear communication, and adapting supply chains, you can position your business for success in a new landscape.

Impact on Innovation in the Industry

When companies merge, the innovation potential often grows. You might wonder, how does this happen? Mergers combine different strengths, ideas, and technologies. This fusion can create new paths for innovation. It’s like mixing colors on a palette; new shades emerge that you never expected.

1. Innovation Trajectories Anticipated from the Merger

After a merger, companies can expect various innovation trajectories. These are often driven by:

- Shared resources: Combining teams and tools can lead to faster problem-solving.

- Diverse perspectives: Different backgrounds can spark creative solutions.

- Increased funding: Mergers often bring more capital for research and development.

For instance, when two tech companies merge, they might pool their research budgets. This can fast-track projects that would have taken longer individually. The outcome? Innovative products that can change the market.

2. Examples of Previous Successful Integrations

History is filled with examples of successful integrations that led to innovation. One notable case is the merger of Disney and Pixar. Before their union, both companies were successful but faced challenges in storytelling and animation. Together, they created blockbuster hits like Toy Story and Finding Nemo. This collaboration not only revitalized Disney’s animation but also set new standards in the industry.

Another example is the merger between Exxon and Mobil. This integration allowed them to combine their research efforts, leading to breakthroughs in energy efficiency. They developed new technologies that reduced production costs and environmental impact. Such examples show how merging can lead to significant innovation.

3. The Role of Tech in Advancing Manufacturing Processes

Technology plays a pivotal role in advancing manufacturing processes post-merger. With combined expertise, companies can:

- Implement automation: Streamlining operations can reduce costs and improve quality.

- Utilize data analytics: Analyzing data helps identify areas for improvement.

- Adopt new materials: Innovative materials can enhance product performance.

For example, consider the automotive industry. Merging companies can share knowledge in electric vehicle technology. This collaboration can lead to faster development of eco-friendly cars. The integration of advanced manufacturing technologies can also improve efficiency and reduce waste.

4. Encouraging a Culture of Innovation Among Team Members

Creating a culture of innovation is crucial. After a merger, it’s important to encourage team members to share ideas. Here are some strategies to foster this culture:

- Open communication: Encourage employees to voice their thoughts without fear.

- Reward creativity: Recognize and reward innovative ideas and efforts.

- Provide training: Equip teams with skills to think creatively and solve problems.

When employees feel valued and heard, they’re more likely to contribute innovative ideas. As an innovation expert once said,

“Innovation often flourishes when companies combine unique strengths and talents.”

This highlights the importance of leveraging individual strengths within a team.

5. Technological Advancements that Foster Innovation Post-M&A

Post-merger, technological advancements can significantly boost innovation. Companies often invest in new technologies, leading to:

- Increased efficiency: Automation and AI can streamline processes.

- Enhanced product development: Rapid prototyping speeds up time-to-market.

For instance, a tech company that acquires a startup with cutting-edge AI can implement these tools to improve its existing products. The result is often a more competitive edge in the market.

6. Funding Trends in Research and Development

After a merger, funding trends in research and development often shift. Merged companies usually allocate more resources to R&D. This increased funding can lead to:

- More patents: Companies can file for numerous patents as they innovate.

- Collaborative projects: Merging teams can work together on groundbreaking projects.

For example, many pharmaceutical companies see a spike in patents filed after a merger. This trend indicates a surge in innovative drug development, which can benefit society significantly.

The outcome of these mergers is often a fresh perspective on innovation. As two different approaches merge into one, the possibilities expand. You might find that the future holds exciting changes driven by these new collaborations.

Market Reactions and Stakeholder Sentiments

The acquisition news can send ripples through the market. Investor reactions often serve as the first indicator of how stakeholders feel about a significant change. So, how do investors respond to such news? They react with their wallets. Stock prices typically fluctuate, reflecting confidence or concern. In the case of Precipart’s acquisition, the market’s immediate response was a telling sign.

Investor Reactions to the Acquisition

Investors tend to analyze the implications of an acquisition closely. They consider various factors, including potential growth, market share, and operational efficiencies. When Precipart announced its acquisition, many investors were optimistic. They believed the move would enhance the company’s capabilities and expand its market reach. This optimism often translates into increased stock prices.

- Stock Price Changes: Following the acquisition news, Precipart’s stock experienced notable changes. Investors reacted positively, pushing the price higher.

- Market Sentiment: The overall market sentiment was one of excitement. Many investors viewed the acquisition as a strategic move that would strengthen Precipart’s position.

However, not all reactions were positive. Some investors expressed caution, worried about integration challenges. This duality in sentiment is common. It highlights the uncertainty surrounding acquisitions.

Responses from Competitors and Analysts

Competitors and analysts have their perspectives on acquisitions. They analyze how these moves affect the competitive landscape. For instance, after Precipart’s announcement, competitors began to reassess their strategies. Some may see it as a threat, while others might view it as an opportunity to innovate.

Analysts play a crucial role in shaping perceptions. They provide insights into market trends and the potential impact of the acquisition. Many analysts praised Precipart’s decision, stating it could lead to increased efficiency and market share. However, they also cautioned about the risks involved. As one market analyst noted,

“Understanding how the market reacts can guide future strategies.”

The Perception of Precipart Among Customers

Customer perception is another vital aspect. How do customers feel about Precipart post-acquisition? Are they excited, indifferent, or concerned? Feedback from customers can provide valuable insights.

- Customer Satisfaction Ratings: Surveys indicated a mixed response. While some customers were thrilled about the new capabilities, others were apprehensive about potential changes in service quality.

- Brand Loyalty: Precipart has a strong brand presence. Many loyal customers expressed confidence in the company’s ability to deliver quality, even after the acquisition.

Understanding customer sentiment is essential for any business. It helps in shaping future strategies and ensuring customer retention.

Feedback Gathered from Industry Surveys

Industry surveys can reveal a wealth of information. They provide a snapshot of how stakeholders feel about an acquisition. For Precipart, these surveys highlighted several key points.

- Overall Sentiment: The majority of industry stakeholders viewed the acquisition positively. They believed it would lead to innovation and improved services.

- Concerns: Some concerns were raised about potential layoffs and changes in company culture. These factors can significantly impact employee morale and customer satisfaction.

By analyzing feedback from surveys, Precipart can address concerns proactively. This approach not only helps in maintaining customer loyalty but also ensures a smoother transition during the acquisition process.

Utilizing Market Analytics to Gauge Stakeholder Sentiment

In today’s fast-paced market, leveraging analytics is crucial. Companies can utilize market analytics to gauge stakeholder sentiment effectively. This means monitoring stock price changes, customer feedback, and competitor responses. By staying informed, businesses can adapt their strategies accordingly.

Tracking these elements allows Precipart to stay ahead of the curve. It helps in identifying potential challenges and opportunities. After all, in the world of business, being proactive is often better than being reactive.

In conclusion, market reactions and stakeholder sentiments play a significant role in shaping the future of a company, especially during acquisitions. By understanding these dynamics, Precipart can navigate the complexities of this transition effectively.

Strategic Alliances: What to Look For

In the fast-paced world of business, strategic alliances are becoming essential. After a company acquisition, the potential for new partnerships can be vast. But what should you look for in these alliances? Here’s a breakdown of key elements to consider.

1. Potential New Partnerships Formed Post-Acquisition

When a company acquires another, it opens the door to fresh opportunities. Think about it: two companies merging means combining resources, talent, and networks. This can lead to partnerships that were previously unimaginable.

For instance, consider a tech firm acquiring a healthcare company. This partnership could lead to innovative health tech solutions. By sharing insights and expertise, both companies can create products that neither could have developed alone. Are you ready to explore these possibilities?

2. Opportunities for Cross-Industry Collaborations

Cross-industry collaborations can be a game-changer. They allow companies to tap into new markets and customer bases. For example, a fashion brand teaming up with a tech company could create wearable technology that appeals to style-conscious consumers.

- Look for industries that complement each other.

- Identify trends that suggest potential market shifts.

- Consider how your company’s strengths can enhance another’s offerings.

Such collaborations can lead to innovative products that meet diverse consumer needs. Are you thinking about how your business can benefit from such alliances?

3. Identifying Synergistic Partners

Finding the right partner is crucial. Not all alliances will yield positive results. You want to look for partners that share similar values and goals. This creates a foundation for collaboration.

Ask yourself:

- What strengths does each partner bring to the table?

- How do our goals align?

- What are the potential risks and rewards?

By carefully assessing these factors, you can identify synergistic partners that will help your business grow.

4. Leveraging Technological Advancements Across the Board

In today’s digital age, technology plays a pivotal role in business. Leveraging technological advancements can enhance the effectiveness of your strategic alliances. For example, using data analytics can help identify consumer preferences, guiding the development of new products.

Consider how technology can streamline processes and improve communication between partners. By embracing new technologies, you can enhance collaboration and drive innovation.

5. Capitalizing on New Relationships

Once you form strategic alliances, it’s time to capitalize on them. This means actively engaging with your partners and finding ways to maximize the relationship. Regular communication is key. Share insights, challenges, and successes. This builds trust and strengthens the partnership.

Recent examples show how companies have successfully capitalized on new relationships:

- A tech giant partnered with a renewable energy firm to develop sustainable solutions.

- A retail company collaborated with a logistics provider to improve delivery services.

These partnerships have led to innovative products and services that benefit consumers and drive revenue growth.

6. The Importance of Data

Data plays a significant role in the success of strategic alliances. Previous statistics show that successful alliances often lead to increased revenue. By collaborating on projects, companies can share resources and insights that drive growth.

For example, a study found that companies engaged in strategic alliances saw a 20% increase in revenue compared to those that did not. This highlights the potential benefits of forming alliances.

“Strategic alliances often lead to breakthroughs that single firms might not achieve alone.” – Business Development Leader

This quote emphasizes the value of collaboration. By working together, companies can achieve what they might not have been able to accomplish independently.

7. Shaping the Future

As organizations adapt and realign their goals, strategic alliances will likely shape the business landscape. The ability to form partnerships that align with a new entity’s vision is crucial. Are you ready to embrace the opportunities that come with these alliances?

In summary, strategic alliances offer numerous advantages. From potential new partnerships post-acquisition to leveraging technology, the possibilities are endless. By identifying the right partners and capitalizing on these relationships, you can drive innovation and growth for your business.

Conclusion

Change is inevitable. In any industry, the only constant is change itself. This reality can be daunting, but it also opens doors to new opportunities. You might wonder, how do we navigate these changes effectively? The answer lies in adaptability. Embracing adaptability is crucial in a rapidly evolving landscape. It’s not just about surviving; it’s about thriving.

The Importance of Adaptability

Adaptability is your best friend in a changing industry. When challenges arise, those who can adjust quickly will find success. Think of it as a dance. You must be willing to change your steps to keep pace with the rhythm of the music. If you resist, you might stumble. But if you embrace the beat, you can create something beautiful.

Statistics show that companies that prioritize adaptability tend to outperform their competitors. They are more resilient and able to pivot when necessary. A recent survey found that organizations with a strong culture of adaptability reported higher employee engagement scores. This leads to a more motivated workforce, ready to tackle challenges together.

Encouraging Ongoing Dialogue Among Teams

Communication is key during transitions. Encourage ongoing dialogue among your teams. This means creating an environment where everyone feels safe to express their thoughts and ideas. When people share their perspectives, you cultivate a culture of innovation. You might ask, how can we improve? What can we do differently? These questions can lead to breakthroughs.

Regular check-ins and feedback sessions can foster this dialogue. They allow team members to voice their concerns and share their successes. Open communication not only helps in addressing issues but also builds trust. When employees feel heard, they are more likely to engage positively with changes.

Prioritizing Employee Well-Being

Change can be stressful. That’s why prioritizing employee well-being during transitions is essential. When you support your team, you create a foundation for success. Consider offering resources like counseling services or wellness programs. These initiatives show that you care about your employees as individuals, not just as workers.

Surveys indicate that companies focusing on employee well-being experience lower turnover rates. Happy employees are more productive and engaged. They become advocates for your organization. This positive culture can transform the way your team navigates change.

Looking Ahead with Optimism

As you face the future, it’s vital to look ahead with optimism. Challenges will come, but they also bring opportunities. Consider this: every time you adapt to a new situation, you grow. You learn. This growth mindset can be your greatest asset. Instead of fearing change, embrace it. Ask yourself, what can we learn from this? How can we turn this challenge into an opportunity?

In the words of a Change Management Consultant,

“In the face of change, adaptability and creativity shine the brightest.”

This quote encapsulates the essence of thriving in a dynamic environment. By fostering adaptability and creativity within your teams, you prepare them to face whatever comes next.

Embracing Growth Amidst Change

Navigating change is not just about surviving. It’s about discovering new pathways to success. Each transition can lead to unforeseen opportunities. Think of it as a winding road. You may not see the destination right away, but each turn can reveal something new and exciting.

As you move forward, remember the potential for growth amidst change. Embrace the challenges, encourage dialogue, prioritize well-being, and keep an optimistic outlook. These principles will guide you and your team through the complexities of change. You have the power to shape your future. So take a deep breath, adapt, and step confidently into what lies ahead.